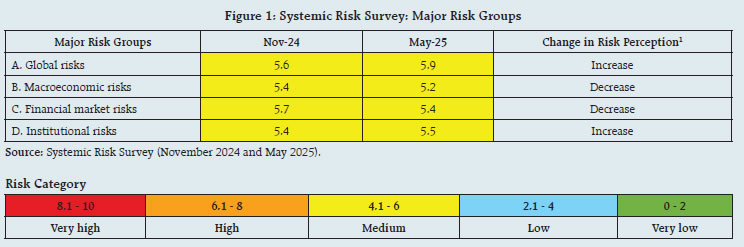

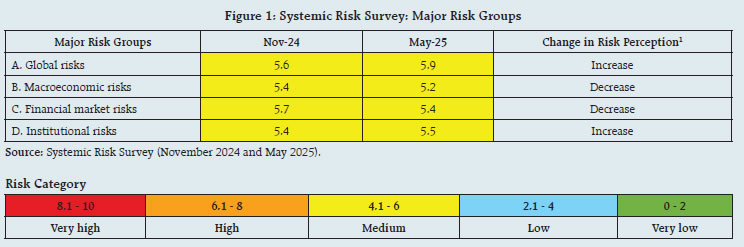

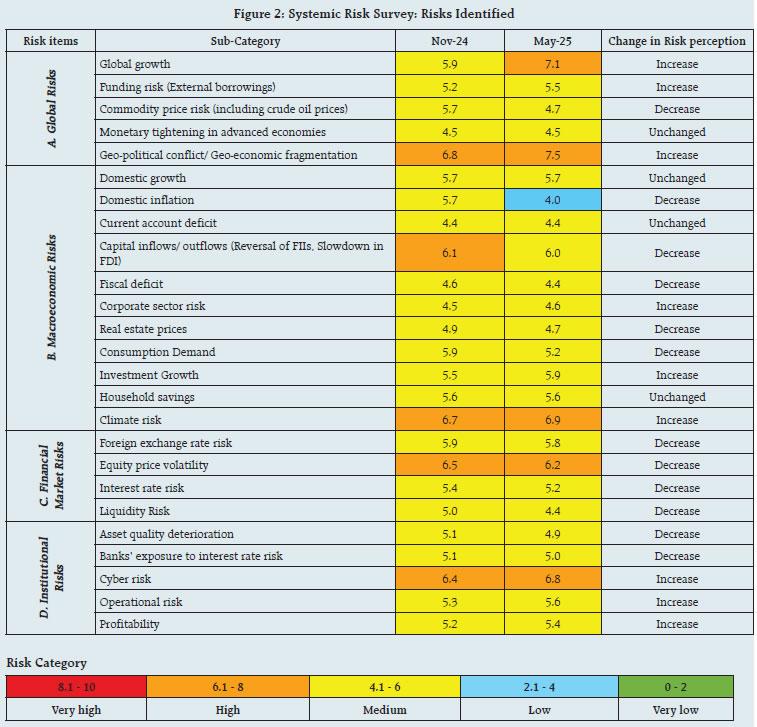

| In the latest round of the Systemic Risk Survey, all the major risk groups were perceived to be in the medium-risk category. Risk perception of global and institutional risks increased marginally, while macroeconomic and financial market risks have moderated due to benign inflation and monetary easing. Overall, the survey respondents viewed geopolitical conflicts, capital outflows and reciprocal tariff/ trade slowdown as major near-term potential risks to financial stability. |

The 28th round of the Reserve Bank’s Systemic Risk Survey (SRS) was conducted in May 2025 to gauge the perceptions of experts, including economists and market participants, on the major vulnerabilities of the Indian financial system. Considering prevailing macroeconomic and financial conditions, the current round of the survey, in addition to regular questions, also captures the respondents’ views on (i) impact of trade tension and protectionist policies on overall financial stability, (ii) effect of trade slowdown on banking sector and (iii) the major sectors affected by global trade disruptions.

A summary of feedback from 50 respondents is presented below.

-

All the major risk groups were perceived to be in the medium-risk category. Risk perception of global and institutional risks increased marginally, primarily on account of global growth concerns, geopolitical conflicts, profitability risk and cyber risk. On the other hand, macroeconomic and financial market risks have moderated due to benign inflation and monetary easing (Figure 1).

-

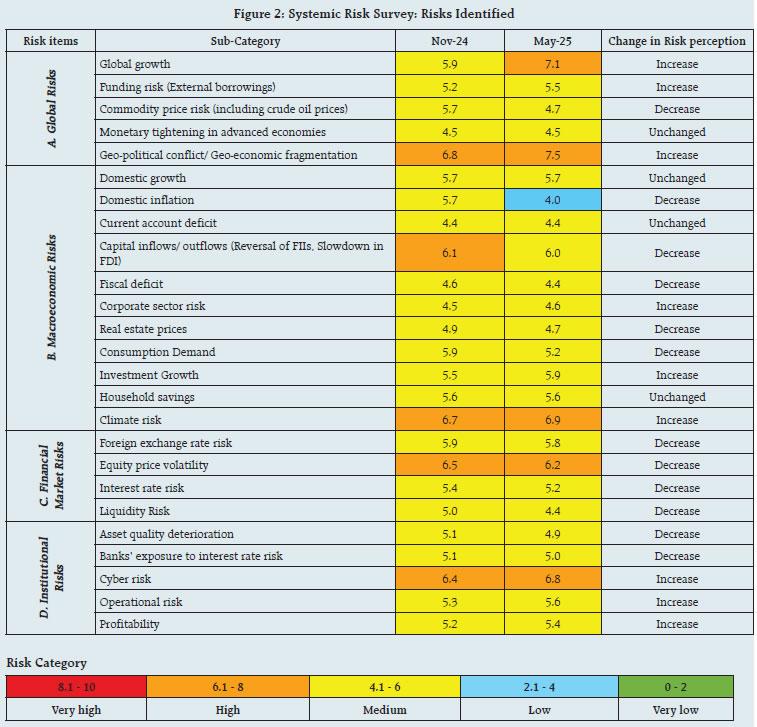

In the global risks, geopolitical conflicts/ geo-economic fragmentation scored the highest (that is, worst risk assessment) compared with other risk sub-categories. Global growth risk moved from the medium to the high-risk category in the latest survey, signalling increasing growth pessimism among the panellists. The funding risk (impact on external borrowings) increased marginally within the medium-risk category.

-

In terms of macroeconomic risks, the risk of investment growth and climate-related risk have increased, whereas inflation risk has decreased significantly and moved from medium to low-risk categories. Other risks such as domestic growth, current account deficits, and household savings remained unchanged.

-

Among the financial market risks, the risk perception of all individual risk categories declined. Equity price volatility continued to remain in the high-risk category.

-

In the case of institutional risks, cyber risk continued to remain a high-risk category, with its risk perception rising further in the latest survey. Operational risk and profitability risk also inched up marginally (Figure 2).

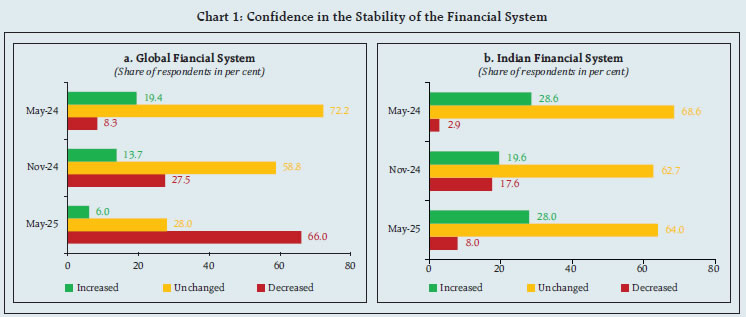

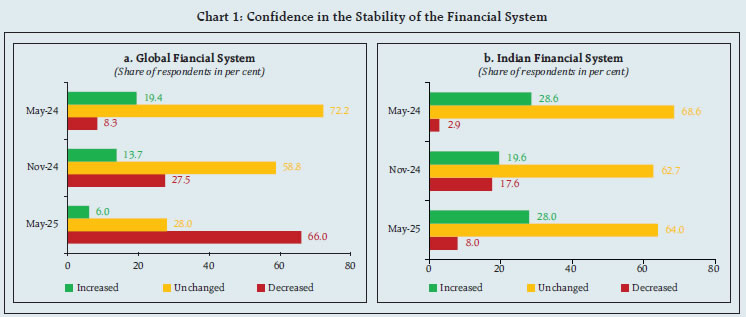

The latest survey shows that 66 per cent of respondents have expressed worsening confidence in the stability of the global financial system, much higher than the 28 per cent in the previous survey. The assessment of the Indian financial system was upbeat, as 92 per cent of them showed a higher or similar level of confidence in the Indian financial system (Chart 1 a and b).

-

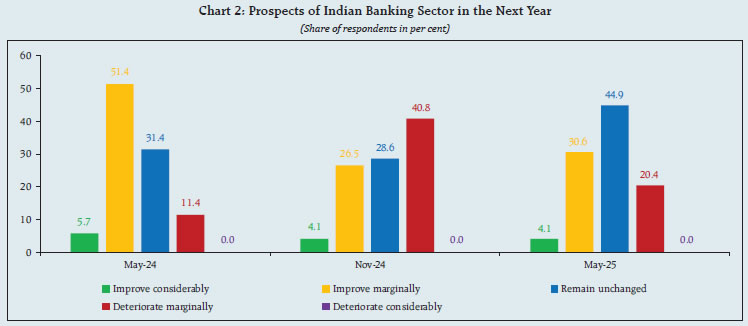

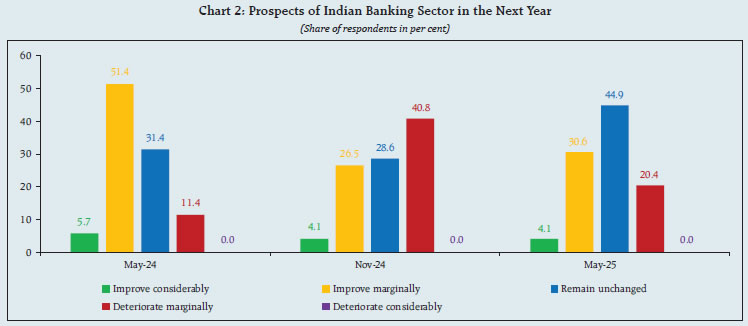

Around 80 per cent of panellists expected better or similar prospects for Indian banking sector over the following year, marking an improvement from the previous survey round (Chart 2).

-

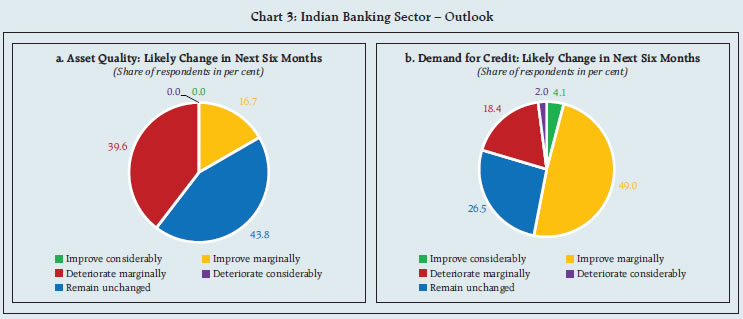

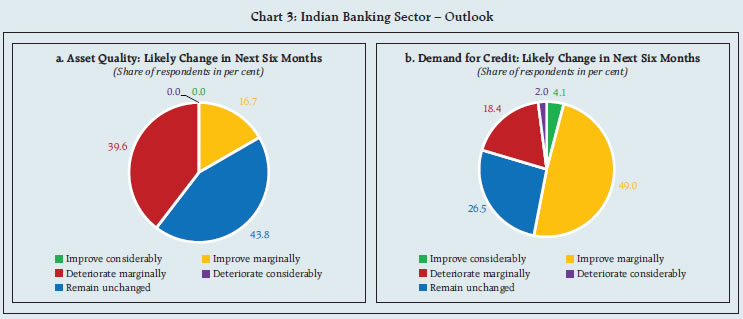

About 60 per cent of panellists expected the asset quality of banking sector to remain unchanged or improve marginally over the next six months, supported by an improved growth outlook, easy liquidity conditions, lower interest rates, and stable prospects for corporate lending. However, 40 per cent of respondents identified factors such as heightened global uncertainty, risks in the export sector, and stress in unsecured lending as potential downside risks to asset quality, thereby expecting a marginal deterioration (Chart 3 a).

-

Around 53 per cent of the respondents assessed the demand for credit to improve in the near-term owing to uptick in rural demand, better business sentiments and improved health of banks. Another quarter of the respondents reported credit demand to remain unchanged (Chart 3 b).

-

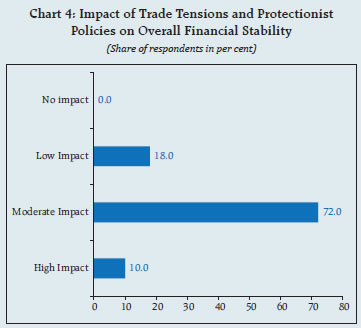

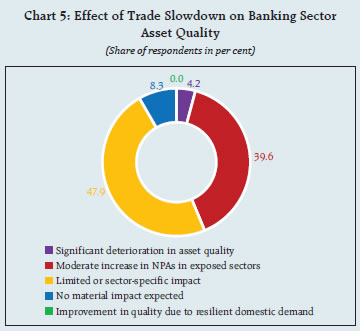

Regarding the impact of trade tensions and protectionist policies, three-fourths of the respondents assessed moderate impact of such disruptions on overall financial stability. However, around 88 per cent of participants expected trade slowdown to have a limited to moderate impact on banking sector asset quality (Chart 4 and 5).

-

Most of the respondents (around 80 per cent) perceived export-dependent manufacturing sectors (e.g. textiles, readymade garments, electronics) and MSMEs in export clusters to face the highest risk due to global trade disruptions. Nearly 40 per cent of respondents assessed the shipping and logistics industry to be the most vulnerable to trade slowdown (Chart 6).

Risks to Financial Stability

Going forward, the respondents identified the following risks to financial stability:

-

Geopolitical conflicts

-

Capital outflows and impact on Indian rupee

-

Increase in trade tariffs and impact on global trade

-

Global growth concerns

-

Climate risk

-

Cybersecurity issues

-

Slowdown in domestic growth

-

Rise in US treasury bond yield

|