IST,

IST,

What's New

-

Mar 06, 2026RBI announces OMO Purchase of Government of India SecuritiesRBI announces OMO Purchase of Government of India Securities

-

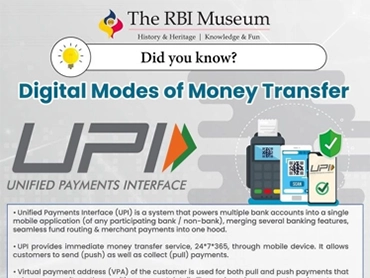

Mar 06, 2026RBI Issues Draft Amendment Directions for ‘Review of Framework of Limiting Customer Liability in Digital Transactions’RBI Issues Draft Amendment Directions for ‘Review of Framework of Limiting Customer Liability in Digital Transactions’

-

Mar 03, 2026Good Finance, Good Leadership: On the Road to Viksit Bharat@2047 - Keynote Address by Shri Swaminathan J, Deputy Governor, Reserve Bank of India, on Friday, February 27, 2026, at the Third International Finance and Accounting Conference (IFAC) at the Indian Institute of Management (IIM), JammuGood Finance, Good Leadership: On the Road to Viksit Bharat@2047 - Keynote Address by Shri Swaminathan J, Deputy Governor, Reserve Bank of India, on Friday, February 27, 2026, at the Third International Finance and Accounting Conference (IFAC) at the Indian Institute of Management (IIM), Jammu

-

Mar 02, 2026Processing of Applications Received Under the Citizen’s Charter – Status as on February 28, 2026Processing of Applications Received Under the Citizen’s Charter – Status as on February 28, 2026

-

Mar 02, 2026Withdrawal of ₹2000 Denomination Banknotes – StatusWithdrawal of ₹2000 Denomination Banknotes – Status

-

Mar 02, 2026Sources of Variation in India’s Foreign Exchange Reserves during April-December 2025Sources of Variation in India’s Foreign Exchange Reserves during April-December 2025

-

Mar 02, 2026Developments in India’s Balance of Payments during the Third Quarter (October-December) of 2025-26Developments in India’s Balance of Payments during the Third Quarter (October-December) of 2025-26

-

No data available for upcoming section

Current Rates

-

Policy Rates

-

Reserve Ratios

-

Exchange Rates

-

Lending/Deposit Rates

-

Market Trends

Policy Repo Rate

Standing Deposit Facility Rate

Marginal Standing Facility Rate

Bank Rate

Fixed Reverse Repo Rate

As on Feb 06, 2026

Policy Repo Rate

As on Feb 06, 2026

5.25 %

Activating the following links will update the graph above.

Standing Deposit Facility Rate

As on Feb 06, 2026

5.0 %

Activating the following links will update the graph above.

Fixed Reverse Repo Rate

As on Feb 06, 2026

3.35 %

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

Activating the following links will update the graph above.

MONEY MARKET :

CAPITAL MARKET :

GOVERNMENT SECURITIES MARKET :

View RBI developments on Social Media